Enrolling in Medicare

We’re here to help.

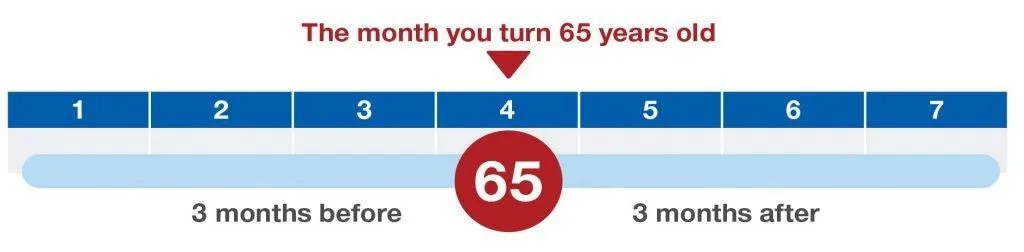

Your Initial Enrollment Period (IEP) spans 7 months, incorporating your 65th birthday month as well as the 3 months before and after. If your birthday falls on the first of the month, the period starts and ends one month earlier. During this time, you can enroll in Part A, Part B, or both. Additionally, you have the option to join a Medicare Advantage plan (Part C) or a prescription drug plan (Part D).

If you qualify for Medicare due to disability, your 7-month IEP includes the month you receive your 25th disability check, along with the 3 months preceding and following that month.

General Enrollment Period

If you miss your Initial Enrollment Period (IEP), you have the option to use the General Enrollment Period (GEP) to enroll in Medicare Part A, Part B, or both. The GEP occurs annually from January 1 to March 31. Additionally, you can opt for a Medicare Advantage plan or a prescription drug plan during the period from April 1 to June 30 of the same year.

Medicare Supplement Open Enrollment Period

Your Medicare supplement open enrollment period spans 6 months, starting from the month you turn 65 or older and enroll in Medicare Part B. While you can apply to enroll at any time after this period, during the open enrollment, you are guaranteed coverage. After this window, you could be denied or charged more based on your health history. Certain states might have additional enrollment periods as well.

Special Enrollment Period: Working past 65

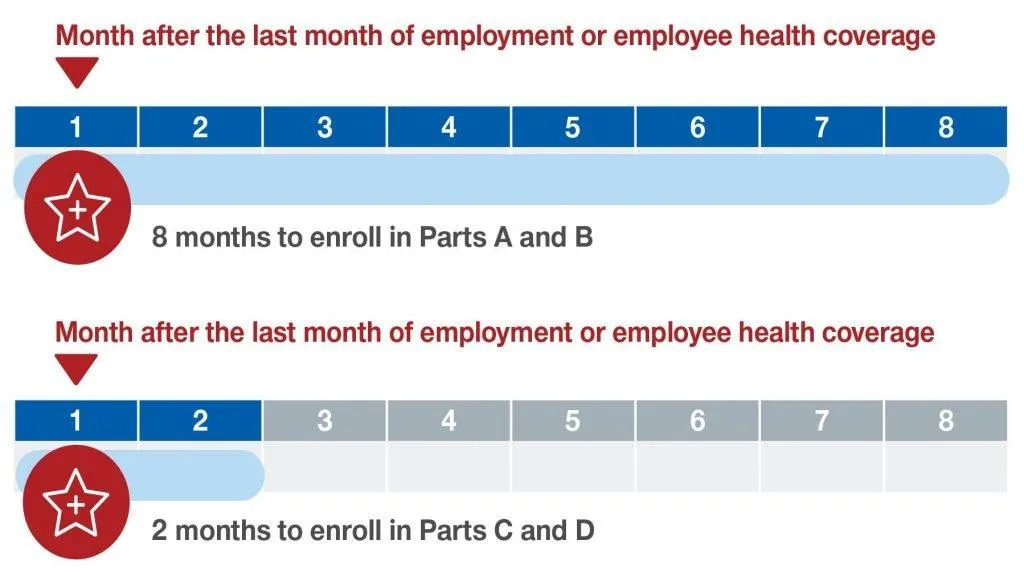

You could be eligible for a Special Enrollment Period (SEP) allowing you to enroll in Part A, Part B, or both without facing penalties for up to 8 months after the month your (or your spouse’s) employment or employer coverage ends, whichever comes first. Additionally, if you qualify, you can join a Medicare Advantage plan or prescription drug plan within 2 full months after the same event.

You have just 63 days to enroll in Part D without penalty once your employer coverage ends. Ask your employer for a notice of “creditable drug coverage.”

Late enrollment penalties

Understanding your enrollment dates and enrolling on time is crucial, as penalties may apply if you miss the deadlines, unless you qualify for a Special Enrollment Period (SEP) or another exception.

For Part A, those who pay a premium (although most don’t) might face an additional 10% of the premium amount as a penalty, charged monthly for twice the number of years enrollment was delayed.

Regarding Part B, a 10% penalty of the premium amount is applicable for each full 12-month period enrollment is delayed, charged monthly for the duration of having Part B.

For Part D, there’s a penalty of an additional 1% of the average Part D plan premium for each month of delay in enrollment, charged monthly for as long as you remain enrolled in Part D.

Concerning Medicare supplement insurance, delayed enrollment might result in denial of coverage or higher premiums based on your health history.

Our agency focuses on Medicare-related insurance solutions, offering expertise in Medicare Supplement (Medigap), Medicare Advantage, Medicaid, Stand-Alone Part D Prescription, dental, final expense, individual, and long-term care plans. We specialize in guiding individuals towards suitable healthcare options tailored to their needs.

Our Services

We assist Medicare-eligible individuals in understanding the fundamental aspects of Medicare and guide them through their Medicare journey. Our goal is to help them make informed decisions, choosing the option that aligns best with their specific needs and requirements.

Copyright © 2023. All Rights Reserved | Terms of Use | Privacy Policy | Disclaimer | Artificial Intelligence Compliance